ADVERTISEMENT

Stride: Mileage & Tax Tracker

Finance

4.2

500 mil+

Revisión del editor

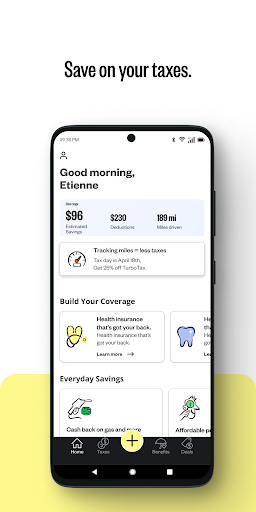

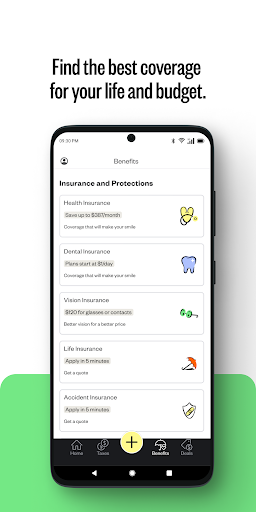

Stride is the completely free expense and mileage tracker for business that helps you automatically track your business miles and expenses and save thousands on your tax bill.

It's perfect for Uber & Lyft drivers, DoorDash delivery drivers, Postmates couriers, Instacart delivery drivers and shoppers, UberEats drivers, Grubhub delivery drivers, goPuff delivery drivers, Shipt delivery drivers, Rover dog sitters, TaskRabbit workers, Amazon Flex drivers, Caviar drivers, mobile independent workers, and self-employed workers including real estate agents, salespeople, hair stylists, and more.

It automatically records your miles, lets you import expenses from your bank and take photos of your business receipts, helps you find money-saving tax deductions and write-offs, and integrates with tax filing software to makes tax filing a breeze at tax time and during quarterly taxes.

Built and designed for self-employed and 1099 workers, Stride helps you find business expenses that you can claim as a self-employed or independent worker to help lower your tax bill. Most people save $4,000 or more at tax time by using Stride!

If you’re self-employed, Stride is the expense and mileage tracker for you!

Stride helps you save time and money:

+ Log miles automatically while you’re driving

+ Record your business expenses and upload your receipts

+ Import and categorize your expenses from your bank account

+ Export your expenses to make tax filing easier than ever

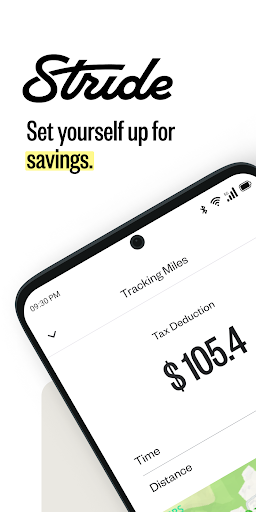

★★★★ Automatically track business miles

Just press start when you leave the house and let Stride run in the background while you work; Stride will automatically track and log every business mile while you drive using built-in GPS. Stride users get $535 back for every 1,000 miles they drive!

+ Automated GPS mileage tracking

+ Reminders to make sure you never miss out on miles

+ Expenses captured in IRS approved format

Accurately log and track mileage, organize and report what you need to maximize your tax deductions and reimbursements.

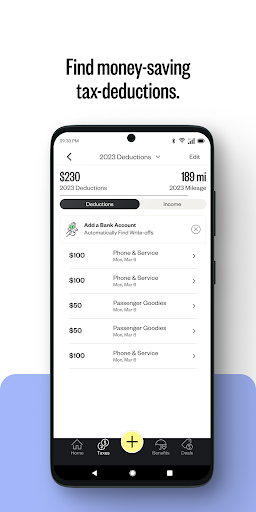

★★★★ Find business expenses, write-offs and deductions

We help you find business expenses you can deduct to help lower your taxes based on the kind of work you do. On average, Stride finds users $200 worth of deductions each week.

+ In-app guidance on what business expenses you can deduct and how to track them

+ Bank integration & receipt photo uploads to easily import expenses

+ Real-time support for any tax tracking questions

Stride users tend to cut their tax bill in half (56%)!

★★★★ Import your business expenses and upload receipts

In addition to automatically tracking your business miles, Stride also lets you import your business expenses from your credit card or bank, and makes it easy to categorize them for tax filing.

Just link your bank accounts and watch your business expenses appear automatically in the Stride app!

★★★★ Get an IRS-ready tax report for easy tax filing

We help you prepare everything you need to file in IRS ready reports.

+ Gathers all the info needed to file in an IRS ready report

+ Helps your taxes be audit-proof

+ Works with all filing methods: e-filing, tax software, accountants

+ Integrates with H&R Block Self-Employed

Stride makes tax filing a breeze!

Track miles, import expenses, upload receipts, find deductions, save money!

+ Automatically log miles

+ Import business expenses

+ Find deductions and write-offs that save money

+ Integrate with tax preparation software that makes it easy to file your taxes

—————————————————————-

Stride is the perfect expense and mile tracker for:

Uber & UberEats drivers

Lyft drivers

Postmates Couriers

DoorDash drivers

goPuff drivers

Weee! drivers

TaskRabbit taskers

Instacart delivery drivers & shoppers

Amazon Flex drivers

Shipt drivers

Caviar drivers

Airbnb Hosts

Rover dog sitters

Delivery drivers

Rideshare drivers

Business consultants

Sales agents

Entertainers

Real estate agents

Anyone who wants to improve their mile iq

ADVERTISEMENT